Lisa DeNoia, author of Coastlined, blogging on and off since 2003. Jersey Girl in Virginia Beach. Entrepreneur, technology innovator, photographer, figure skater, traveler, sailor, avid lover of books. Guardian of Benny, also pictured above.

The Year in Review

December 31, 2024

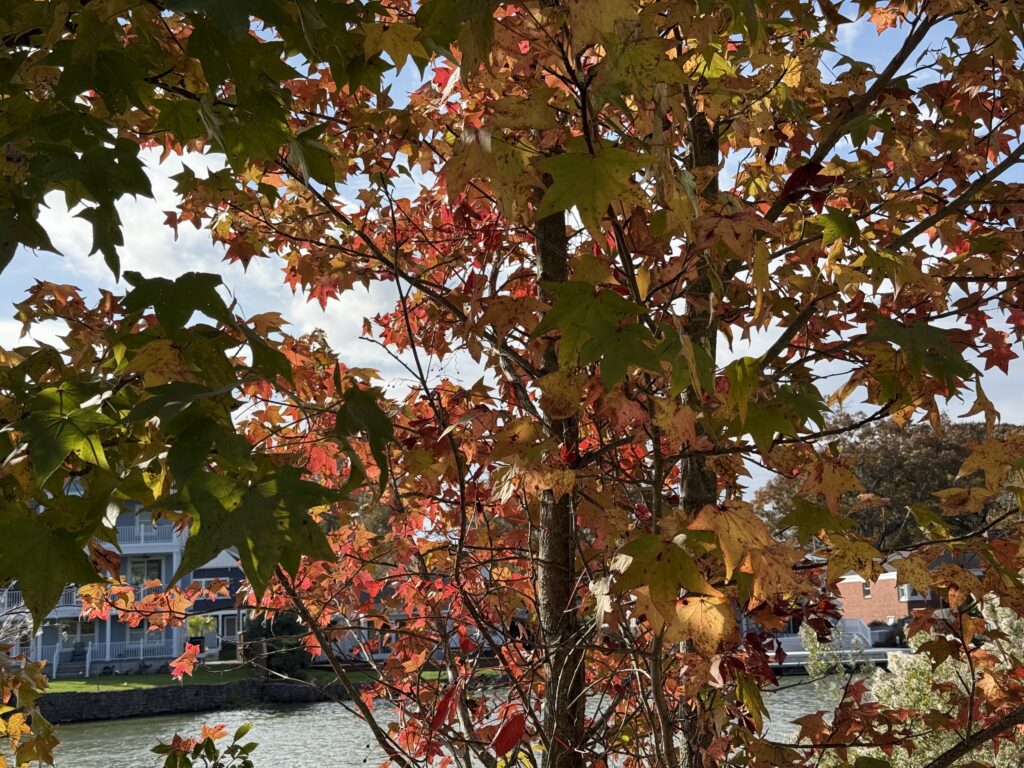

Scenes from my Autumn Dog Walks

November 25, 2024

The Grey Lady

September 2, 2024

The Year in Review

December 31, 2023